ev tax credit bill text

Briefly lets look at a. Federal tax credit for EVs jumps from 7500 to 12500 Keep the 7500 incentive for new electric cars for 5 years.

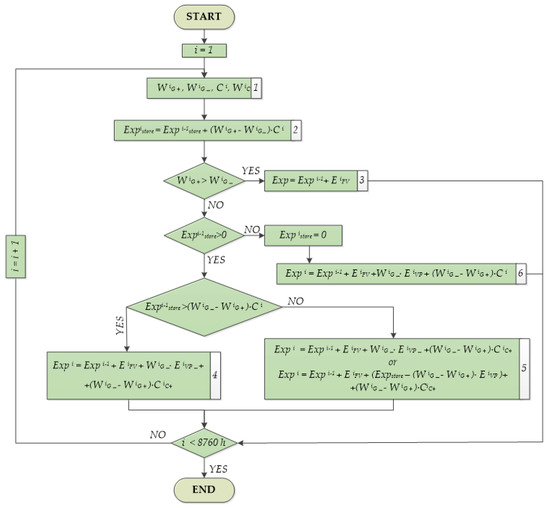

Energies Free Full Text Estimating The Economic Impacts Of Net Metering Schemes For Residential Pv Systems With Profiling Of Power Demand Generation And Market Prices Html

The amount of the credit will vary depending on the capacity of the battery used to power the car.

. This bill modifies and extends tax credits for electric cars and alternative motor vehicles. The bill says individual taxpayers must have an adjusted gross income of no more than 400000 to get the new EV tax credit. 4000 Base Tax Credit.

Under the bill the expanded tax credit is available to taxpayers with an adjusted gross income cap of up to 250000 for individuals and. Meanwhile Republicans on the senate. All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit.

Preliminary Senate Finance Committee text for the social spending and climate bill released over the weekend retains a tax credit for union-made electric vehicles despite objections to. The exceptions are Tesla and General Motors whose tax credits have been phased out. Democrats Unveil New EV Tax Credit Proposal.

Its good news for General Motors which recently begged the government. As mentioned below however the 10 kWh battery. On Wednesday the Senate Finance Committee advanced the Clean Energy for America Act making a few tweaks from earlier proposals.

There is a federal tax credit of up to 7500 available for most electric cars in 2022. This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours. Senate Finance Committee Approves 12500 EV Tax Credit Bill.

The Clean Energy for America bill which advanced on a 14-14 tie vote would eliminate the existing EV cap while the credit would phase-out over three years once 50 of US. However most people who file their federal taxes and buy or lease a new EV are eligible for a credit of up to 7500. It would limit the EV credit to.

Beginning on January 1 2021. If you purchased a Nissan Leaf and your tax bill was 5000 that. The US Senate Finance Committee has put forth a bill to extend and strongly improve the US federal EV tax credit.

For more information about the new Democratic proposal check out these links. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. Small neighborhood electric vehicles do not qualify for this credit but.

Changes include raising the federal EV tax rebate ceiling to 12500 and opening the door for automakers who already exhausted. The proposed EV incentive under Build Back Better includes a current 7500 tax credit to purchase a plug-in electric vehicle as well as 500 if. State andor local incentives may also apply.

Updated June 2022. Tax Credit Amount 417 x Total Capacity kWh - 4kWh 2500 For the federal credit a manufacturer will have its credit value halved once 200000 electric vehicles are sold. The proposed EV incentive under Build Back Better includes a current 7500 tax credit to purchase a plug-in electric vehicle as well as 500 if.

By MASS COMMUNICATION SPECIALIST 1ST CLASS PATRICIA RODRIGUEZ Navy Office of Community Outreach. By Matt Posky on May 27 2021. A Senate version of the EV plan had initially proposed to offer an additional tax credit beyond the base 7500 of 2500 for the buyers of.

Senator Joe Manchin told reporters that the additional union-built EV tax credit has been. The tax credit is also. Increasing the base credit amount to 4000 from 2500 is fine.

The text of the electric vehicle tax credit as it is included in the 175 billion of the budget reconciliation bill can be found here. Add an additional 4500 for EVs assembled in. The EV tax credit remains at 7500 for all electric models except those made by Tesla and General Motors.

When I woke up this morning I found the text of the Senate bill HR1 - Tax Cuts and Jobs Act that was passed last night and skimmed through it looking for anything about the Federal electric. Electric Credit Access Ready at Sale Act of 2021 or the Electric CARS Act of 2021. The current tax credit has a base of 2500 and is replaced with a new 4000 base credit as long as the EV has a battery of at least 10 kWh and can be plugged in and recharged.

Access additional state and local EV incentives. Secure a federal tax credit of up to 7500. The federal EV tax credit is calculated based on different factors.

After the failure of the Build Back Better bill in late 2021 the existing proposals for the expansion of the EV tax credit were abandoned. The bill says individual taxpayers must have an adjusted gross income of no more than 400000 to get the new EV tax credit. Here is the text of the House bill HR 5376 as of 10-28-2021 EV credits begin on page 1240.

Preliminary Senate Finance Committee text for the social spending and climate bill released over the weekend retains a tax credit for union-made electric vehicles despite objections to the. The credit amount will vary based on the capacity of the battery used to power the vehicle. The bill extends the tax credit for new qualified plug-in electric drive motor vehicles through 2031.

State and municipal tax breaks may also be available. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. Depending on your tax circumstances you could be getting up.

In addition the bill modifies the credit to.

Pdf Life Cycle Cost Assessment Of Electric Vehicles A Review And Bibliometric Analysis

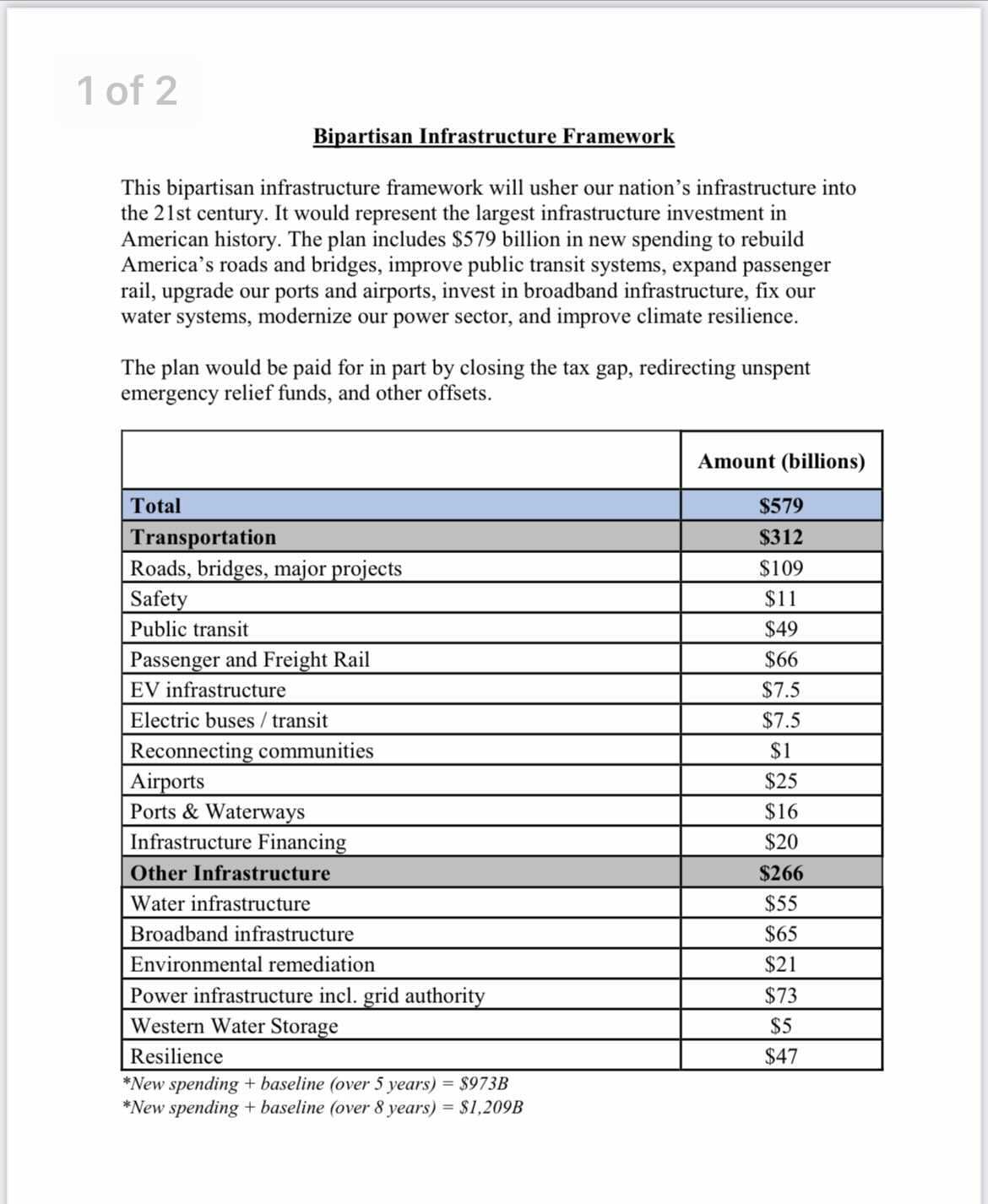

Eur Lex 52021sc0170 En Eur Lex

Pdf China S Electric Vehicle Subsidy Scheme Rationale And Impacts

Factors Determining Working Capital Requirement In 2022 Accounting And Finance Factors Personal Finance

28 Sweet Taylor Swift Quotes About Friendship From Her Best Song Lyrics Taylor Swift Quotes Taylor Swift Lyrics Best Song Lyrics

Latest On Tesla Ev Tax Credit June 2022

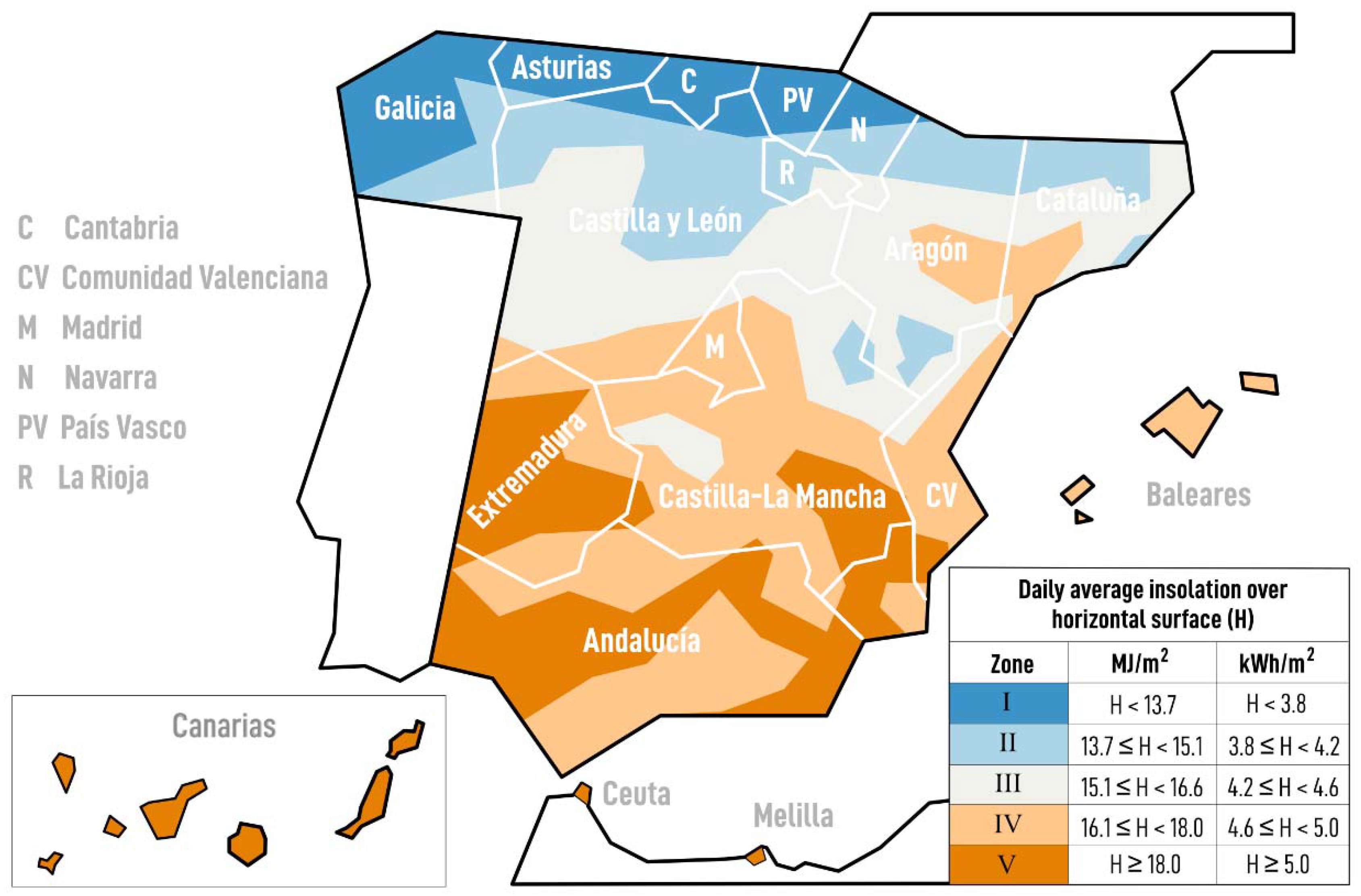

Sustainability Free Full Text Spanish Photovoltaic Solar Energy Institutional Change Financial Effects And The Business Sector Html

It May Be Cheaper To Run Maintain And Be Better For The Environment But For Washingtonians Didyouknow Facts Twenty Dollar Bill Gas Tax Personal Finance

What Are Regulatory Credits And How Tesla Made It A Business Tesla Tesla Shares Automotive Sales

Senator Heinrich To Introduce Energy Storage Tax Credit Bill Next Week Energy Storage Solar Power Energy Energy

Pdf Overview Of Incentives And Policies For Electric Vehicles In The European Countries

All About Power Optimizer Power Solar Power Solar Energy

Here Are 15 Ways For You To Save Money When Shopping Online Especially If You Re An Online Shopper Enthusiast Money Saving Tips Saving Money Ways To Save

Everything You Need To Know About Ev Incentives In The Netherlands Evolve

Electric Car Electric Bill Off 79

Cyber Liability Insurance Joseph M Wiedemann Sons Inc Cyber Crime Liability Insurance